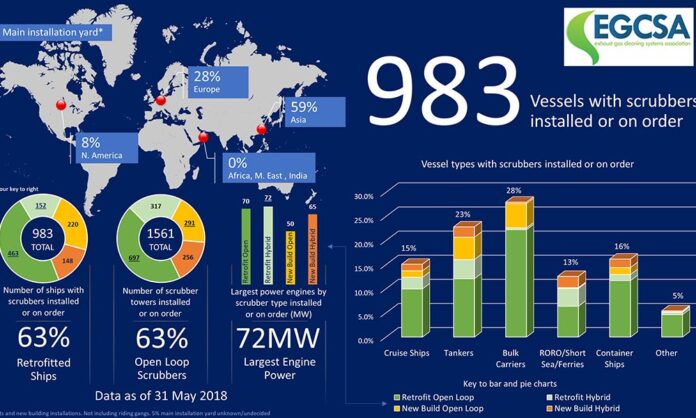

A survey of the Exhaust Gas Cleaning Systems Association (EGCSA-UK) members has revealed that scrubber uptake is rapidly accelerating with the number of ships with exhaust gas cleaning systems installed or on order standing at 983 as of 31 May 2018.

This follows a slew of recent reports that major ship operators, including Spliethoff, Frontline, DHT and Star Bulk have opted for scrubbers. One of the ‘big’ container companies has confirmed it will use scrubbing as part of its 2020 compliance portfolio and there are rumours that others will do likewise.

Until relatively recently the largest installed exhaust handling capacity has been for engine powers in the region of 25 to 30MW. However, the latest data shows that this has been well and truly exceeded by a retrofitted hybrid system for a 72MW container ship engine. Large capacity scrubbers are not confined to retrofits as the maximum size new building installation is a hybrid system for a 65MW engine.

Nearly 60% of all retrofits and new building installation works take place in Asian yards. Unsurprisingly this increases to nearly 85% of new building installs. EGCSA believes that although there has been a surge in demand, yard capacity is not an issue going forward, however other constraints such as the availability of laser scanning specialists and experienced installation teams mean that it may not be possible to pick and choose an installation slot nor coincide a scrubber installation with an already scheduled drydock in the near future.

Needless to say, the majority of EGCSA members are still taking orders with several now taking options through to 2023 to enable ship-owners to secure a position on the installation timetable.

Back in 2015 in readiness for the switch to 0.10% sulphur fuel, a number of RoRo and ferry operators led the way and successfully chose scrubbers as a means of compliance. The cruise industry came next and now with 2020 looming, bulk carriers have taken over at the top of the ship types adopting exhaust gas cleaning, with container ships and tankers following. In each of these sectors retrofit open loop installations predominate.

The survey shows that 63% of all ships have either been or will be retrofitted with scrubbers, while 37% are new building installations. 988 of the 1561 individual scrubber towers installed or on order are for open loop scrubbing; confirming it as the most popular exhaust gas cleaning system.

EGCSA is not surprised that open loop scrubbing is preferred. It is the simplest scrubbing system and favoured by ship crews. Although many early adopters in the North Sea and Baltic fitted hybrid systems, they are operated for the majority of time in open loop. Open loop scrubbing has also been used for years by coastal power stations and by oil tanker inert gas (IG) systems when in port without environmental issues.

While closed loop and hybrid systems are available for enclosed bodies of water with little water exchange or where discharges are restricted by local regulation, ECGSA suggests the alternative of switching to low sulphur fuel for the port stay where open loop operation is not possible. The cost impact is likely to be limited as over 90% of fuel consumption is during full away at sea, which is where the financial benefits really accrue.

Deliveries until 2022

Statistics from DNV GL show an even higher number of scrubber-equipped vessels. According to figures from the beginning of August 2018 there are 1290 ships with confirmed scrubber projects. Of these 1207 will be commissioned by the end of 2019.

Editors note: according to statistics of DNV GL there are about 50.000 vessels worldwide in operation (the given numbers vary to different sources – others say there are around 70.000 vessels) – what will happen to them if they will not have scrubber installations at the given time schedule and navigate in SECA-zones?

Distributed by type of vessels bulk carriers count for 31 per cent, oil and chemical tankers for 26 per cent, Container vessels for 15 per cent, cruise vessels for 11 per cent and roro-vessels for 7 per cent.

According to DNV GL the four largest suppliers Wärtsilä, Alfa Laval, Ecospray and Yara Marine have a total market share of 70 per cent, followed by Clean Marine, Panasia and Langh Tech with a total market share of 12 per cent. The rest of the market is shared by Bilfinger, CROE, Feen Marine, SAACKE, DuPont, Pacific Green Technologies, VDL AEC Maritime and PureTeQ.

Manufacturers Statement

Laura Langh-Lagerlöf, Commercial Director at the Finnish scrubber manufacturer Langh Tech Oy Ab, confirms that there has been a dramatic increase in the request for tenders for scrubber installations. The Company also recentIy closed its largest deal so far and will deliver scrubber systems for the Danish shipping Company Dampskibsselskabet Norden A/S. Langh Tech will retrofit four MR tankers and eight bulk carriers in the Norden-fleet with scrubbers of open loop-type.

„There has been a huge increase in demand for scrubber systems lately and in addition to Norden’s order we have dozens of new scrubber systems in the pipeline. At the same time, we are increasing our capacity which allows us to keep offering systems with delivery before 2020“, she says

Safe choice

Langh-Lagerlöf thinks that one reason for the major interest in scrubber installations is that it is considered a safe choice.

„In a newbuilding project there is a jungle of different options. Scrubber feels like a safe choice because it is likely that the price of heavy fuel oil will remain at a relatively low level compared to other marine fuels.“

According to her, received requests for scrubber installations on newbuildings show that the majority of shipping com-panies want at least that their ship will be ready for a later installation of a scrubber plant.

„If they chose to install a scrubber, the most demanded option is the hy-brid-ready open loop. Then the plant is ready for later upgrading to closed loop.“ Langh-Lagerlöf thinks that the interest in systems designed for open Ioop only gradually will decline. „Most shipping companies expect that the environmental requirements will be more and more stringent and want to ensure that they are able to operate the scrubber plant also in the future.“